free cash flow yield explained

Free Cash Flow is an important metric but the level of FCF by itself does not provide enough information for an investment strategy. Free Cash Flow Yield Free Cash Flow Market Capitalization.

Unlevered Free Cash Flow Definition Examples Formula

These metrics compare the companys value to the markets assessment of the company to determine if an investment is attractive.

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

. Free Cash Flow Yield Free Cash Flow Market Capitalization. Since this measure uses free cash flow the free cash flow. FCF is a useful valuation metric to determine a firms operating performance.

Called the free cash flow yield this gives investors another way to assess the value of a company that is comparable to the PE ratio. Free Cash Flow Explained. The simplest way to calculate free cash flow is to subtract capital expenditures from operating cash flow.

Then the free cash flow value is divided by the companys value or market cap. Free Cash Flow Yield. Free cash flow measures how much cash a company has at its disposal after covering the costs associated with remaining in business.

Generally firms with strong cash flows are financially healthy as opposed to firms with weak FCFs may be unable to meet their short-term obligations. Free Cash Flow Operating Cash Flow CFO Capital Expenditures. Free cash flow yield explained Tuesday May 31 2022 Edit.

In this weeks short video I explain how it works. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to evaluate real estate investments. Where FCFF FCFF FCFF Free cash flow to firm or unleveled cash flow is the cash remaining after depreciation taxes and other.

Fcf Yield Unlevered Vs Levered Formula And Calculator What Is Free Cash Flow Yield Definition Meaning Example. The FCFY provides an additional indication of a firms operating. Cash may be King but FCF yield is an Ace.

The ratio is exceedingly. Per Valuation 101 smart investing is about buying low expectations and selling high expectations. Thats the ratio of free cash flow to market cap.

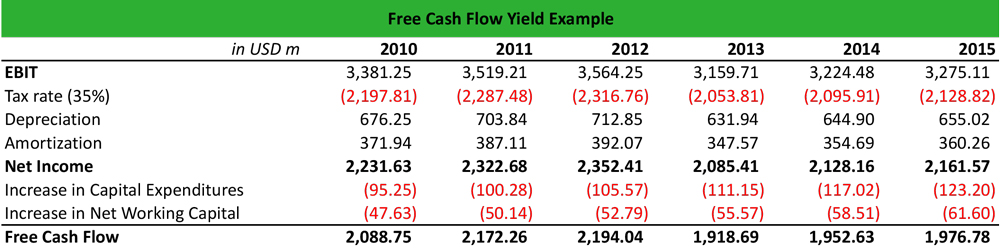

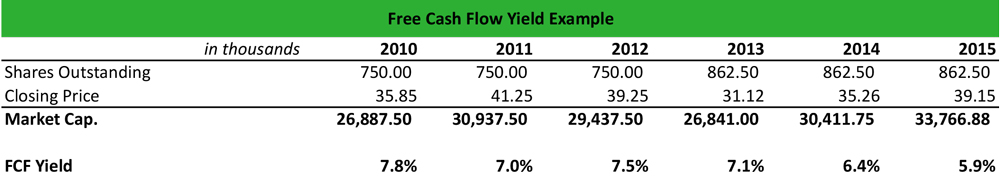

The completed model output is shown below. What free cash flow means for a company and why investors should definitely look at it before buying in. This ratio expresses the percentage of money left over for shareholders compared to the price of the stock.

When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model. Free Cash Flow Yield Free Cash Flow Market Capitalization. Free Cash Flow Yield measures the amount of cash flow that an investor will be entitled to.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. We need a metric that tells how highly the market is. This ratio expresses the percentage of money left over for shareholders compared to the price of the stock.

Of those using discounted free cash flow models FCFF models are. What is the definition of free cash flow yield. Free Cash Flow Yield - Michael Mack Portfolio Manager.

As an example let Company A have 22 million dollars of cash from its business operations and 65 million dollars used for capital expenditures net of changes in working capital. Thats 2 the same as the bond. The free cash flow yield FCFY is a financial solvency metric that compares a companys predicted free cash flow per share to its market value per share.

Free cash flow yield is really just the companys free cash flow divided by its market value. Instead of market capitalization it uses the price you paid for an investment as the denominator. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company.

The ratio is computed by dividing free cash flow per share by the current share price. To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations. Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to.

These High-Yield Stocks Are Teaming Up to Add More Fuel. FCFY Free cash flow to firm FCFF Enterprise Value. Free Cash Flow Yield Explained.

Free cash flow yield is widely quoted by analysts and gives investors a useful insight into whether a share is cheap or expensive. When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model. It represents the amount of cash flow available to all the funding holders debt holders stockholders preferred stockholders or bondholders.

It is mechanically similar to thinking about the dividend or earnings yield of a stock. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115. Analysts may have to do additional or slightly altered calculations depending on the data at their disposal.

The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn against its market. A higher free cash flow yield is better because then the company is generating more cash and has more money to pay out dividends pay down debt and re-invest into. FCFF FCFF Free cash flow to firm or unleveled cash flow is the cash remaining after depreciation taxes and other investment costs are paid from the revenue.

Free Cash Flow Yield Formula Top Example Fcfy Calculation Levered Free Cash Flow Lfcf Definition. Valuation metrics offer investors a simple way to assess a companys worth by looking at its sales earnings and cash flow. Free Cash Flow Yield FCFY We can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis.

Free Cash Flow Yield. As an analytical tool free cash flow FCF is valuable for determining a companys operating potential. Formula 2 FCFF Free cash flow yield calculation from a firms perspective equity holders preferred shareholders and debt holders is as follows.

Most information needed to compute a companys FCF is on the cash flow statement. Lets take a look at the most. Free cash flow yield is a financial ratio that measures how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow per.

For example if you paid 100000 for a.

Free Cash Flow Uses One Of The Most Important Metrics In Finance

Fcf Yield Unlevered Vs Levered Formula And Calculator

What Is Free Cash Flow Yield Definition Meaning Example

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Yield Formula Top Example Fcfy Calculation

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator